Discover how easy it is to create a business budget you can stick to. This is the secret to knowing exactly what is happening with your business and what your bottom line needs to be month over month.

Create a budget that you can modify on a monthly basis without feeling suffocated or annoyed. I’ll explain all the variables of a business budget and how to set one up for your small business.

The Importance of A Business Budget

Does the word “budget” make you cringe? Even if you hate to budget, it’s important to know your monthly operating expenses to have a profitable business.

Once you’ve calculated your average monthly expenses, make sure the business generates enough sales or has enough cash reserves in a business savings account to cover monthly and yearly obligations. If you’re not sure where your money is going every month, creating a budget is the first step to getting a handle on your business finances.

Create a Business Budget – Simple Steps

Don’t be overwhelmed with the word budget. It’s pretty easy. Before you begin any calculations, you need software. You can use something like FreshBooks or Quickbooks.

Another solution I like to use is Microsoft Excel. This method is fairly simple—just grab a free excel budget template, and use it.

After you have some kind of software for recording your expenses, you are ready to make a budget. It’s as easy as these 8 steps.

- Record recurring charges. Gather your credit card or bank statements, or search your accounting software tool (i.e. FreshBooks) to look for recurring charges.

- Mark monthly or yearly expenses. Write down the vendor name, amount, and mark whether the expense is a monthly or yearly expense.

- Add up all the monthly obligations.

- Calculate the annual subtotal. Now multiply the total in Step #3 by 12 months to get your total yearly amount for monthly obligations.

- Add up all the yearly obligations.

- Calculate the total yearly expenses. Add together the total in Step #4 and Step #5. This is your total yearly expenses for the business.

- Calculate the average monthly expenses. Divide the total yearly expenses calculated in Step #6 by 12 months. This is your average monthly expenses for the business.

- Evaluate spending and saving habits. Decide if you need to make changes to your business to cover the average monthly expenses that you calculated in Step #7.

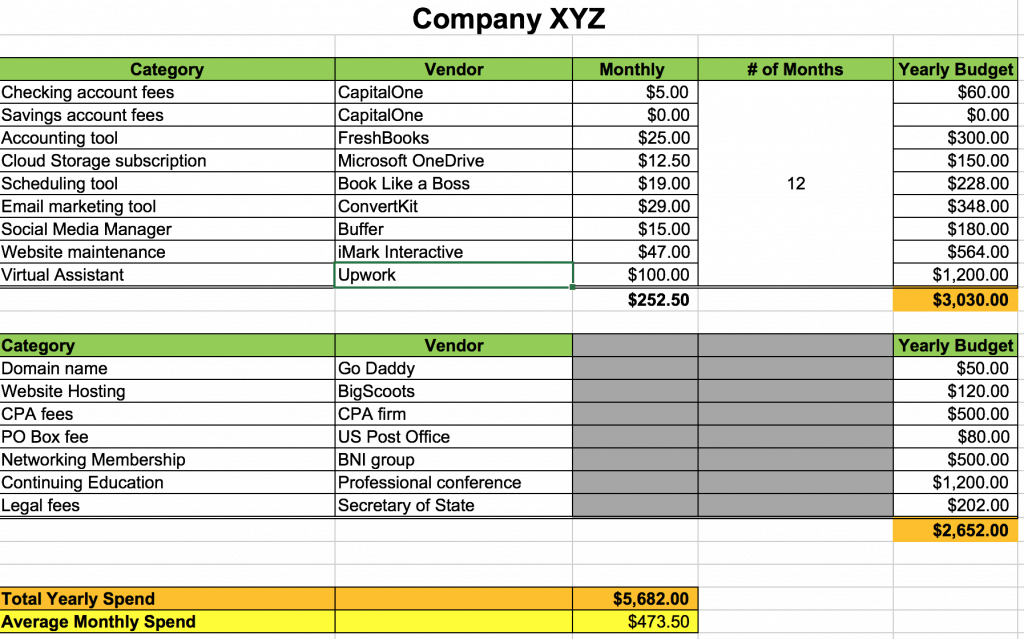

Business Budget Example

Here’s an example of monthly and yearly expenses for a service-based business using the steps as outlined above. You can see all the numbers in the spreadsheet image below. Then, I’ll explain how to calculate the average monthly expenses for the budget, references the above steps (starting at step 3).

- Step 3: Monthly Obligations = $252.50

- Step 4: Total Yearly Amount for Monthly obligations = $252.50 x 12 = $3,030.00

- Step 5: Yearly Obligations = $2,652.00

- Step 6: Total Yearly Expenses = $3,030.00 + $2652.00 = $5,682.00

- Step 7: Average monthly expenses = $5,682.00 / 12 = $473.50

In this example, the business owner needs to generate $473.50 in sales each month to cover his monthly and yearly obligations. If there are months where sales are high, then he should transfer money into the emergency savings account for cash reserves in the event of a slow month.

Typical Expenses for a Business

To create a budget, a great place to start is to refer to Schedule C (Form 1040) – Part II for categories of allowable IRS business expenses.

Other detailed examples of expenses to include in your small business budget include:

- Domain name

- Website hosting

- CPA fees

- PO Box rental

- Accounting software and payment solution (i.e. FreshBooks)

- Checking / Savings Account Maintenance fees

- Cloud Storage subscription (i.e. Microsoft OneDrive)

- Scheduling tool subscription

- Email marketing tool subscription (Note – I switched from MailChimp to ConvertKit, and love the tool.)

- Meals and Entertainment for business meetings (Do you spend too much time and money on coffee meetings?)

- Virtual Assistant

Summary: What if Your Small Business Is Not Making Enough Money?

If you’ve calculated your average monthly expenses and have now realized that your business isn’t making enough money to cover the bills or pay yourself an owner’s draw/salary, then here’s what you do.

Increase Sales or Decrease Expenses

You’ll either need to increase sales or find ways to decrease your expenses. It really is as simple as that.

While signing up for several $10 or $15 per month tools to support or run your business can initially seem like no big deal, evaluate these tools at least once a year and cancel the ones that are no longer useful.

I find that most business owners are surprised at how quickly their monthly or yearly subscriptions for software tools, continuing education, and coffee meetings/networking events can add up and eat into their profits. I also see many small business owners forget that they signed up for a tool since it’s on automatic credit card payment, and forget to cancel before the annual renewal.

Keeping a list of all the monthly and yearly obligations in a single budget spreadsheet will help you manage and evaluate if you need to eliminate expenses.

I’d love to hear your thoughts and experience: What expenses do you have for your business that are a must-have? Do you have any subscriptions that you’ve forgotten about and have been paying for?

Read Similar Posts:

- 7 Solutions to Earning More Money

- Ultimate Guide to Organizing Your Business Finances – Chapter 5: How to Do Taxes the Right Way

- Small Business Finance for the Busy Entrepreneur – Chapter 9: Don’t Go Broke Over Monthly and Yearly Obligations

- FreshBooks offers Double-Entry Accounting

- How Much to Invest In Yourself