Do you know how to read and understand your profit and loss statement? I’ll explain what a profit and loss statement is and how to read one.

Being familiar with a profit loss statement is crucial for any business owner. This one report will show you how to earn more money in your small business and help you stop spending money in places you don’t need to be.

What is A Profit and Loss Statement?

The profit and loss statement, commonly referred to as P&L, is one of the most important financial statements to help you understand if changes need to be made in your business. It reflects if your business is making more money than its spending, and gives an overview of total revenues, cost of sales, total expenses, and net profit (or loss).

Given that this is the most important report that you can use to manage your business, are you actually reading your P&L statement, knowing what the numbers mean?

I find that many small business owners don’t look at their P&L statements, because they don’t know how to read or interpret the numbers. Or, they don’t know how to create one because they aren’t using accounting software like FreshBooks or QuickBooks.

When you started your business, you probably didn’t expect to get deep into the numbers. Now, you may be wondering if you need to take a class in accounting? I can understand how frustrating and confusing the finances and reports can be, especially when there are usually several names for the same report or data!

Do you know if your business is making a profit or experiencing a loss?

Understanding a Profit and Loss Statement

You don’t need to major in accounting to have a successful business, but you also don’t want to rely 100% on your accountant to help you understand your P&L statement.

The three things you’ll need to start understanding how to read and understand your P&L report are:

- Get smart on the terminology for inputs / outputs on the P&L statement.

- Know how to generate or create a Profit and Loss report.

- Find your net profit (or loss) per quarter or year.

Definitions of Terms on a P&L Statement

Here’s an overview of terms and definitions for the inputs and outputs on a P&L report:

- Revenue – This is the income that a business receives from the sale of goods and services. It is also referred to as Sales or Income.

- Cost of Sales – This is the cost to create a product or service that has been sold. This can also be known as the Cost of Goods Sold or COGS. (*Note – Service providers tend to use the term cost of sales and manufacturers and retailers tend to use the term cost of goods sold.)

- Gross Profit – This is calculated as Total Revenue minus Total Cost of Sales.

- Expenses – These are costs incurred to operate the business and provide products and services. They include fixed (i.e. overhead expenses) and variable costs.

- Net Income – This is calculated as Gross Profit minus Total Expenses. If this number is positive, there is a net profit. If negative, there is a net loss.

- Profit and Loss Statement (P&L) – This shows the net income or loss the business has incurred over a period of time (i.e. quarter or year). It is also referred to as Income Statement.

How to Read a Profit and Loss Statement in Quickbooks

Now that you know what all of the terms mean, what should you look for when you read through your P&L statement? There are some numbers and figures that you should pay extra-close attention to.

Let’s take a look at an example to show what you should look for when reviewing your Profit and Loss Statement.

Example of Profit and Loss Statement

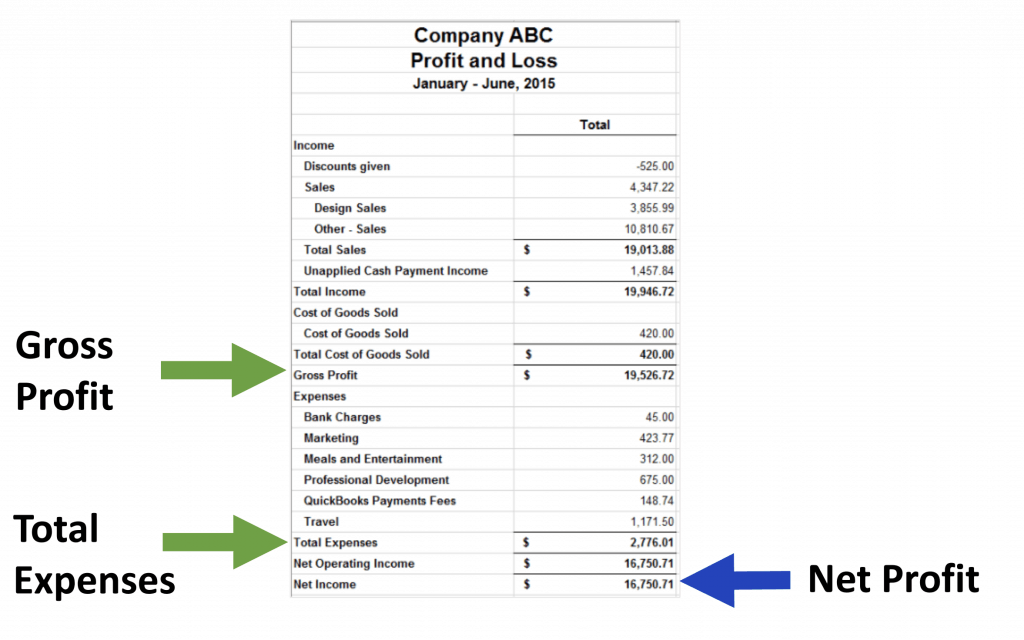

Example of Profit and Loss Statement for a business.

In this example, Company ABC used QuickBooks and generated a report based on the data that was in the system. The report showed the following over the first two quarters of that year:

- Total Revenue / Sales : $19,946.72

- Cost of Sales / Cost of Goods Sold: $420

- Gross profit: $19,526.72

- Total expenses: $2,776.01

- Net Profit: $16,750.71

- Profit or Loss? This business owner is making a profit in her business.

General Observations from Company ABC P&L Statement

The first thing to look at is time and marketing money. If the business owner wants to understand where to focus her time and money (i.e. marketing/advertising), she should look at which product/service makes up most of her sales.

Next, pay attention to the top product/service – “other-sales.” This is the most profitable service, given that it makes up 57% of total sales. ($10,810.67 / $19,013.88 = 57%). However, is this really the key offering for this business owner given she also offers Design Sales? It seems that “Other – Sales” is a secondary offering given that it’s listed as “Other.”

Finally, be specific when you categorize items and products. The “Sales” of $4,347.22 is too general. This made up 23% of the business sales, but what type of sales was this? It’s hard for the business owner to know which product or service to focus on or expand if there aren’t enough detail in the reporting.

Why It’s Important to Understand Your Profit & Loss Statement

Understanding your profit and loss statement will provide you insight into what is working or not working in the business. You can see what changes you may need to make, such as cutting costs (if cost of goods sold is too high), raising prices (if sales revenue is too low), or eliminating a product /service offering (if sales are low and not a substantial percentage of overall sales).

And if you’re looking for funding for your business, lenders will want to see your P&L statement to see if and when you will become profitable and can repay your loan.

Learning how to read a profit and loss statement for your business can help you focus your time and money on the right areas of your business. Most business owners can’t tell me their most profitable products/services.

Only when diving into their P&L statement, some owners start to realize that the product or service that they were spending their time and advertising dollars on was not the best use of their time or money.

Next Steps: Look At Your P&L Statement

Get started today and pull your Profit and Loss statement from your accounting software. What numbers jump out at you, or seems off?

If you don’t have accounting software, I highly recommend trying FreshBooks. Get a free trial to see if it works for you and your business.

Want a hands-on FreshBooks demo that includes using your real data? Book a session with me.

If you like this post and want more details and other templates, check out my bestselling book, Small Business Finance for the Busy Entrepreneur.

If you’re just getting started in business and don’t want to pay for a software tool yet, you can also use Excel. See the example below.

As you can see, a profit and loss statement doesn’t need to be overly complicated. If you prefer a simple spreadsheet, that can work—just make sure you keep up with updating it manually.

Do you see any trends or numbers in your P&L Statement that don’t make sense to you? If so, share your thoughts or questions in the comments!